Why protect your pet with Direct Line

We understand that your pet is part of the family and it can be very stressful if something happens to them. We'll help you look after them if they get sick or hurt, because an emergency trip to the vet can cost thousands of pounds. Not everyone has this money to hand.

Pet insurance from Direct Line can help with any unexpected vet bills. We offer Dog insurance as well as Cat insurance, which are designed to give you peace of mind and help keep your pet healthy and happy.

Cover levels to suit your pet

We have a choice of cover levels to give your pet the protection that best suits your needs and theirs.

10% of new business single pet customers achieved these prices online for pet cover between 01/07/2021 – 31/12/2021. Excludes optional extras. Cover is only available providing the policy remains in force.

Multi-pet discount

Save 12.5% if you have more than one pet to insure on the same policy

Many people have more than one pet in their family. If you have multiple four-legged friends, our policy lets you insure them all together on one policy with a combined monthly premium and one renewal date.

If you're an existing customer, add new pets at any time by giving us a call on 0345 246 8705, and they'll be covered straight away.

Multi-pet discount is introductory and applies for the first 12 months of the policy.

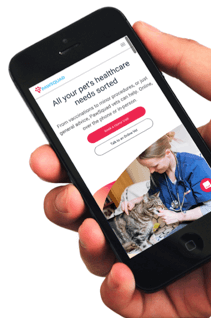

Protect your pet round the clock with 24/7 online access to a qualified vet

Free access to PawSquad, offering live chat and video calls with UK vets who can answer your questions.

- 24/7 advice from a UK qualified vet wherever you are

- Video calls enabling vets to see your pet face-to-face

- Text chat with the option to upload images

Direct Line has partnered with Pet Drugs Online, so you can get more out of your pet insurance.

Save on your pet's medication Direct Line has partnered with Pet Drugs Online, so you can get more out of your pet insurance.

- Discounted medication so your claim limit can go further, which is especially helpful for ongoing treatments

- Prescription fees covered up to £15

- Discounted pet food, toys and general health products

Compare our pet insurance cover levels

Our pets are all different. That's why we have two types of customisable cover.

What policy is right for you?

We recommend you insure your pets for any costs you couldn't pay yourself. A few things to consider may be:

- A pedigree can be more at risk of hereditary conditions and theft.

- Cover tends to be cheaper for younger, healthier pets.

- What if you need to put your pet to sleep? We can help with these costs.

- Some conditions require care and medication for over a year.

| Essential cover | Advanced cover | |

|---|---|---|

|

Vets' fees per condition

Necessary treatment for each separate condition |

Up to £4,000 | Up to £8,000 |

|

Time limit per condition

Maximum time each condition is covered |

12 months

from the first date of treatment |

No time limits |

|

Cover for accidents, injuries and disease

Including dental accident |

||

|

Complementary treatments

Including physiotherapy and hydrotherapy |

||

|

Dental disease

Treatment costs for tooth and gum disease |

Up to £1,000

included in the overall vet fee limit |

|

|

Euthanasia

Cover towards the cost of having to put your pet to sleep |

Up to £100

included in the overall vet fee limit |

|

|

24/7 free online vet access with PawSquad

A video and online chat service |

||

|

Help when you need it

Practical legal advice and bereavement helplines |

||

|

5 in 1 care package

We will cover advertising and reward fees, pet boarding, death of a pet, lost pet and holiday cancellation fees

|

Optional

for an additional cost |

Optional

for an additional cost |

|

Third party liability for your pet (dogs only)

Up to £2.5 million towards costs awarded against you as a result of an accidental incident involving your pet If your dog injures someone or damages their property and you're found to be legally responsible, we'll pay up to £2.5 million towards compensation and costs awarded against you by a court. We'll also cover the legal costs and expenses for defending a claim. For property damage claims, there's a £250 excess. If you already have liability cover under another policy, such as home insurance, we'll only accept your claim if that cover has been used up. |

Optional

for an additional cost |

Optional

for an additional cost |

|

Overseas travel cover

For journeys to countries included in the UK Government's Pet Travel Scheme This provides cover for your pets when travelling abroad, as long as you follow the guidelines of the UK Government. Please note, we don't offer third party liability cover under the laws of Canada or USA. In addition to already selected cover, you'll get:

Cover is valid for three overseas journeys a year, each no more than 30 days. |

Optional

for an additional cost |

Optional

for an additional cost |

Why protect your pet with Direct Line

We understand that your pet is part of the family and it can be very stressful if something happens to them. We'll help you look after them if they get sick or hurt, because an emergency trip to the vet can cost thousands of pounds. Not everyone has this money to hand.

Pet insurance from Direct Line can help with any unexpected vet bills. We offer Dog insurance as well as Cat insurance, which are designed to give you peace of mind and help keep your pet healthy and happy.

Cover levels to suit your pet

We have a choice of cover levels to give your pet the protection that best suits your needs and theirs.

Essential Cover

Get a quoteAdvanced cover

Get a quoteMulti-pet discount

Save 12.5% if you have more than one pet to insure on the same policy

Many people have more than one pet in their family. If you have multiple four-legged friends, our policy lets you insure them all together on one policy with a combined monthly premium and one renewal date.

If you're an existing customer, add new pets at any time by giving us a call on 0345 246 8705, and they'll be covered straight away.

Multi-pet discount is introductory and applies for the first 12 months of the policy.

Protect your pet round the clock with 24/7 online access to a qualified vet

Free access to PawSquad, offering live chat and video calls with UK vets who can answer your questions.

- 24/7 advice from a UK qualified vet wherever you are

- Video calls enabling vets to see your pet face-to-face

- Text chat with the option to upload images

Direct Line has partnered with Pet Drugs Online, so you can get more out of your pet insurance.

Save on your pet's medication Direct Line has partnered with Pet Drugs Online, so you can get more out of your pet insurance.

- Discounted medication so your claim limit can go further, which is especially helpful for ongoing treatments

- Prescription fees covered up to £15

- Discounted pet food, toys and general health products

Make a claim

Claim online

Claiming online is quick and easy, just fill out our form so we can deal with your vet directly.

Make a claimHow do pet insurance claims work?

You can make a pet insurance claim online, over the phone or by posting us a form.

Depending on the vet and your needs, valid claims will work in one of two ways:

We pay you. You pay the vet bill and then make your claim. We'll then refund you this cost minus the excess.

We pay the vet. After you make a claim, we'll pay the vet directly, minus any excess, which you must pay to the vet.

The excess is the amount of money you must pay towards each of your pet's conditions you claim for. This was agreed when you took out the policy.

Learn morePet insurance tips, FAQs and policy documents

Download pet insurance policy documents

You can download our pet insurance policy documents for a full list of what isn't covered.

-

Policy document

Updated 13th January 2026 -

Essential pet insurance IPID

Updated 13th January 2026 -

Advanced pet insurance IPID

Updated 13th January 2026

What can impact my premium?

- Age. The older your pet gets, the more expensive your cover is likely to be. This is because your pet is more prone to chronic medical conditions in its later years.

- Rising vet fees. Fees are increasing throughout the UK because vets can now provide more advanced treatments.

- Breed. Some breeds are more expensive to insure as they’re more susceptible to certain medical conditions.

- Claims. If you make a claim it is likely to impact your premium the following year.

- IPT. If Insurance Premium Tax either increases or decreases, insurance premiums are impacted.

- Discounts. Our introductory Multi-Pet and 25% discounts only apply for the first year of your policy, so your premium may increase after renewal.

- Pre-existing conditions. A pre-existing condition is any condition or symptoms, or signs of injury or illness, that happen or exist in any form before the pet was covered by this insurance. Before taking out insurance, make sure pre-existing conditions are covered

Frequently asked questions

Although we don't provide a 'lifetime' policy, our Advanced policy will cover each separate illness or injury up to £8,000. There's no time limit on how long we will cover the condition for as long as your policy remains in force with us. In 2019 only 1.1% of closed claims reached the £8,000 limit.

It means any condition or symptoms or signs of injury, illness or disease which occurred or existed in any form, prior to taking out a policy with us.

Should any illness or disease occur during the first 14 days of taking out a policy, this would also be classed as pre-existing and therefore not covered.

Once a pet starts having treatment for a medical condition under a policy it becomes a pre-existing condition. Any ongoing claims would be covered up to the limit as described in your policy, but if you take out a new policy or change insurer in the future you should check whether cover for pre-existing conditions is provided.

If you were unaware of your pet's condition when you took out your policy, then hereditary and congenital conditions are covered.

As with any illness or disease, your pet must not be exhibiting any signs or symptoms of the condition prior to or within 14 days of the cover starting.

When you get in touch, one of our Claims Advisors will let you know approximately how long your claim will take to process. As long as we have all the information required, and you claim within the terms of the policy, we will settle a claim as quickly as possible.

PawSquad is a 24/7 vet advice line exclusively available for Direct Line Pet customers. Independent practicing vets are available to discuss any problem, anytime, either through online chat or video chat.

Latest articles

Dog vaccinations: everything you need to know

Vaccinations can protect dogs against catching serious, sometimes fatal diseases. Find out what vaccinations your dog needs and when.

What is a pedigree dog?

If two dogs of the same breed have a puppy, that little pup is considered to be purebred. In order to be classed as a pedigree, the puppy must also be added to a pedigree dog registration scheme run by a recognised club or society.

Dog theft - how to prevent your dog being stolen

Dogs are stolen more often than you might think. Read our guide to find out how you can help prevent dog theft and what is covered by pet insurance.