Manage your policy

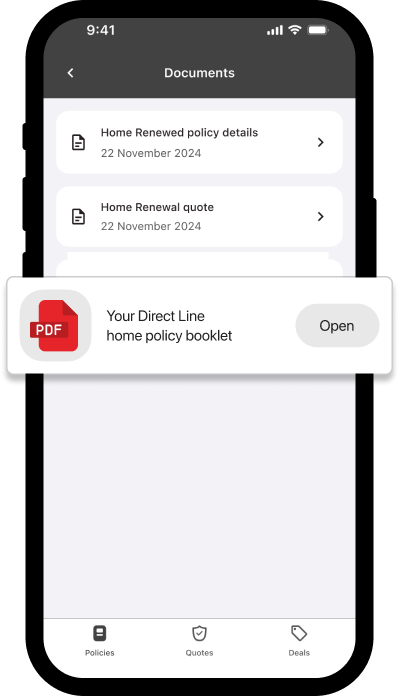

Sign in to view your policies, make changes, retrieve quotes and download documents.

Sign inHelp and support

The help you need wherever you are.

Get helpHome claims

Start a new claim or contact us about an existing claim.

Make a claim

What is home insurance?

Home insurance can cover you against nasty surprises that affect the building you live in and the things you keep there.

Whether that’s swiftly replacing a stolen phone, having a plumber fix a spurting water pipe, or finding you somewhere to stay if your home can’t be lived in following an insured event. We’ll be there when you need us.

You can focus on making the most of the place you call home.

Home insurance to cover what matters most

Our home insurance comes in two parts, which can be bought separately or together. Which cover you'll need depends on a variety of reasons, including if you’re a homeowner or renter, and the type of property, such as a freehold house or leasehold flat.

Buildings and contents

This is your typical homeowner insurance, which covers damage to the property itself and the items inside the house.

Get a quoteBuildings only insurance

Covers the main structures of your home, including permanent fixtures. This is often a requirement of any mortgage.

Get a quoteContents only insurance

Covers your possessions within your home. This might be suitable if you rent, lease or already have buildings insurance.

Get a quoteWhat is covered by Direct Line Home Insurance

We offer three cover types with varying policy limits. Use the table to compare our cover levels.

What am I covered for?

- Somewhere for you and your family to stay if an insured event means you can't live at home

- Damage caused by fire, lighting, storm or flood, theft, vandalism and more

- Locks and keys for outside doors replaced if they're lost or stolen

What am I not covered for?

- Wear and tear, maintenance and routine decoration

- The cost of repairing or replacing items following a mechanical or electrical fault

- Damage or theft if the house has been unoccupied for more than 60 days in a row

For full detaills, see our policy document (pdf)

Compare cover limits

Get to know what's included before you choose your cover.

| Essentials | Home | Home Plus | |

|---|---|---|---|

Buildings sum insured

More about buildings sum insuredThis is the rebuild cost for your home. It's different from your home's market value or council tax band, as those include the value of the land. If something happens to your home and the structure needs to be rebuilt, your buildings sum insured is is the upper limit of what you can claim. It covers permanent fixtures and fittings both outside and inside, including kitchen units, patios, garden walls, gates, fences and outbuildings. Get an idea of how much you might need using the rebuild cost calculator from the Building Cost Information Service (BCIS). Full details are in your policy document. |

Up to £500,000 | Up to £1 million | Unlimited |

Contents sum insured

More about contents sum insuredIf something happens to your contents and they need to be replaced, this is the upper limit of what you can claim. This might be an appliance or an antique, a bed or a bicycle. Whatever the type of thing, if it's part of your home contents (but not your car or something of your landlord's), this is the sum that covers it. Full details are in your policy document. |

Up to £50,000 | Up to £175,000 | Up to £175,000 |

Trace and access (buildings)

More about trace and accessIf a water leak or oil leak is causing damage and part of your building needs removing to get to the source of the leak, we'll cover the cost. That means both the removal, and the cost of getting things back to normal. We won't cover the thing that's leaking, such as a tank, pipe, appliance or heating system. Full details are in your policy document. |

Up to £2,500 | Up to £5,000 | Up to £10,000 |

Service pipes and cables

More about service pipes and cablesFor pipes and cables that run underground to service your home, and for which you're legally responsible, we'll cover accidental damage. The same goes for tanks and drains. Full details are in your policy document. |

Up to £2,000 | Included | Included |

Theft from outbuildings (contents)

More about theft from outbuildingsCover for items that are stolen (or damaged during a theft) from your garage or other outbuilding that's part of your home. Full details are in your policy document. |

Up to £2,500 | Up to £5,000 | |

Personal possessions

More about personal possessionsYou can add cover for items that you normally wear or carry when you're out and about. This means items worth £2,000 or less each, such as phones, watches, glasses and sports equipment. For Home and Home Plus customers, the cover includes up to 60 days abroad in any one policy year. Full details are in your policy document. |

Optional Up to £2,000 single item limit (UK only) |

Optional Up to £2,000 single item limit (UK and 60 days Worldwide) |

Included Up to £4,000 single item limit (UK and 60 days Worldwide) |

Alternative accommodation for you and your pets

More about alternative accommodationIf we've accepted a claim, and the repairs mean you can't stay at home, talk to us about your plans for somewhere else to stay. Once we've agreed the costs with you, we'll cover where you're staying and kennel fees for any pets, as well as lost rent. The same applies if your home is occupied by squatters. Full details are in your policy document. |

Buildings up to £25,000 Contents up to £15,000 |

Buildings up to £25,000 Contents up to £15,000 |

Buildings up to £50,000 Contents up to £30,000 |

Matching sets and suites

More about matching sets and suitesFor bathroom suites or fitted kitchens, if you've got a set or a suite of which one part is damaged beyond repair, we'll aim to replace that part. For bathroom suites or fitted kitchens, if you've got a set or a suite of which one part is damaged beyond repair, we'll aim to replace that part. Full details are in your policy document. |

Included | ||

Property Owner's Liability

More about Property Owner's LiabilityWe'll cover the damages you have to pay for accidental harm to someone else or their property, up to the relevant cover limit. We may also cover expenses and legal fees, where we've agreed this in writing beforehand. Full details are in your policy document. |

Up to £1 million | Up to £2 million | Up to £5 million |

Accidental Damage (buildings)

More about accidental damage (buildings)This covers things that happen to your buildings suddenly, unexpectedly and unintentionally. It’s not for general wear and tear, or things that just break down. Buildings examples include:

Full details are in your policy document. |

Optional | Optional | Included |

Frozen food

More about frozen foodIf the food in your fridge or freezer gets spoiled because of the appliance having an unexpected temperature change or refrigerant leak, we'll cover the cost of any spoiled food. Full details are in your policy document. |

Up to £500 | Included | Included |

Accidental Damage (contents)

More about accidental damage (contents)This covers things that happen to your contents suddenly, unexpectedly and unintentionally. It’s not for general wear and tear, or things that just break down. Contents examples include:

Full details are in your policy document. |

Optional | Optional | Included |

Home Emergency cover

More about Home Emergency coverNew parts, labour and callout charges are all included for emergency repairs up to £500 per callout. Examples include:

Full details are in your policy document. |

Optional | Optional | Included |

Family Legal Protection

More about Family Legal ProtectionGet cover for legal costs if there’s a greater than 50% chance of success. With 24/7 access to legal assistance. Examples include:

Full details are in your policy document. |

Optional | Optional | Included |

Frequently asked questions

If you choose to renew automatically, your renewal won't be any higher than if your policy isn't set up for automatic renewal.

If you don't select automatic renewal, you'll still get a renewal invite before your policy end date. However, cover will stop on the policy end date if you haven't contacted us to renew it.

If you do choose the convenience of automatic renewal, then you will not need to contact us next year to renew your policy.

Yes, if you take out our Personal Possessions cover. This is available as an optional extra for Direct Line Home Insurance and Direct Line Essentials, when you select contents cover. Your personal belongings (including up to £500 for Money) will be covered against theft, loss or accidental damage anywhere in the UK and Republic of Ireland.

A Direct Line Home Insurance policy with Personal Possessions will also get cover for up to 60 days abroad each year.

Any individual items worth more than £2,000 must be specified on a Direct Line Home Insurance or Direct Line Essentials policy.

Personal Possessions cover is included as standard with Direct Line Home Plus, when you select contents cover. Your personal belongings (including up to £1,000 for Money) will be covered against theft, loss or accidental damage anywhere in the UK and Republic of Ireland, plus for up to 60 days abroad each year. Any individual items worth more than £4,000 must be specified on the policy.

Yes, when moving home. With Home Insurance, Home Plus and Home Essentials, we’ll provide cover for your contents while in a professional storage facility for up to 72hrs. Your contents would also be covered against accidental loss or damage while you're in the process of moving.

China, glass, earthenware or other fragile items aren't covered.

For Home Insurance and Home Essentials policies, you need to tell us the value of individual items of jewellery, fine art, watches, antiques and sporting guns over £2,000.

For Home Insurance Plus, this applies to items over £4,000.

If you're selling your home, the buildings section of our Home Insurance and Home Insurance Plus policies automatically cover the buyer up to the date that the sale completes. Direct Line Home Essentials policies do not contain this cover.

No matter your cover, if you need insurance for a new property you're in the process of buying or a property you've already moved into, you'll need to speak to our customer services team on 0345 246 3564 .

Direct Line Buildings Insurance has Trace and Access cover. This includes removing and replacing any part of the building to find the source of water or oil escaping from tanks, pipes, appliances or fixed heating systems, which is causing damage to the building.

Cover limits:

- Direct Line Home Essentials: £2,500

- Direct Line Home Insurance: £5,000

- Direct Line Home Plus: £10,000

What's not covered is repairing or replacing the tanks, pipes or heating systems themselves.

Yes. Direct Line Home Essentials and Home Insurance customers with buildings cover get up to £25,000 for the cost of comparable, alternative accommodation, kennel fees for pets and lost rent. This applies if all or part of your home is not fit to be lived in when a valid claim has been made, or your home is occupied by squatters. Cover is up to £50,000 with Home Insurance Plus.

Direct Line Home Essentials and Home Insurance customers with contents cover get up to £15,000 for the cost of comparable, alternative accommodation, kennel fees for pets and the temporary storage of your contents. This applies if all or part of your home is not fit to be lived in when a valid claim has been made. Cover is up to £30,000 with Home Insurance Plus.

Latest articles

Fair prices at Direct Line

From January 2022, all insurers must make sure existing customers are offered the same price at renewal as they would get when buying a new policy. In the insurance industry, this rule change is known as Pricing Practices Regulation, or PPR.

Your guide to building a home extension

As moving house can be expensive, many of us opt to improve our existing homes rather than buying somewhere else. But extending your house to create extra space has its challenges. We've put together a few tips to help smooth the process.

The true cost of running your home

Do you want to reduce the cost of running your home? Mortgage payments, energy costs, council tax, home insurance, water charges - the costs can seem never-ending. So, it's good to cut back where you can. Check out our handy tips to discover what you can do to lower your bills.